Mortgage interest tax deduction 2020 calculator

However higher limitations 1 million 500000 if married filing. For taxpayers who use married filing separate.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

. Throughout the course of your mortgage the interest on your mortgage. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Mortgage Tax Deduction Calculator The interest you pay on your mortgage or any points you paid when you took out your loan could be tax deductible. However higher limitations 1 million.

Ad Determine monthly payments and loan possibilities on country homes and land. You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebt-edness. Use this calculator to see how much you.

Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. 2020 interest tax relief From April 2020 landlords will no longer be able to deduct their mortgage costs from. The interest paid on a.

A taxpayer spending 12000 on mortgage interest and paying taxes at an individual income tax rate of 35 would receive only a 4200 tax deduction. Download Or Email Pub 936 More Fillable Forms Register and Subscribe Now. Build Your Future With a Firm that has 85 Years of Investment Experience.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. That means this tax year single filers and married couples filing. 2020 Simple Federal Tax Calculator Enter your filing status income deductions and credits and we will estimate your total taxes for tax year 2020.

Use the mortgage tax savings calculator to determine how much your mortgage payments could reduce your income taxes. Mortgage Tax Savings Calculator. Ad Access Tax Forms.

Build Your Future With a Firm that has 85 Years of Investment Experience. Currently the home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of principal. 877 948-4077 call Schedule a Call.

This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Based on your projected tax withholding for. Complete Edit or Print Tax Forms Instantly.

Home Uncategorized mortgage interest tax deduction 2020 calculator. Apply online for a home or land mortgage loan through Rural 1st. Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage debt on.

Suma Yonkers Fcu Marginal Tax Rate Calculator

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

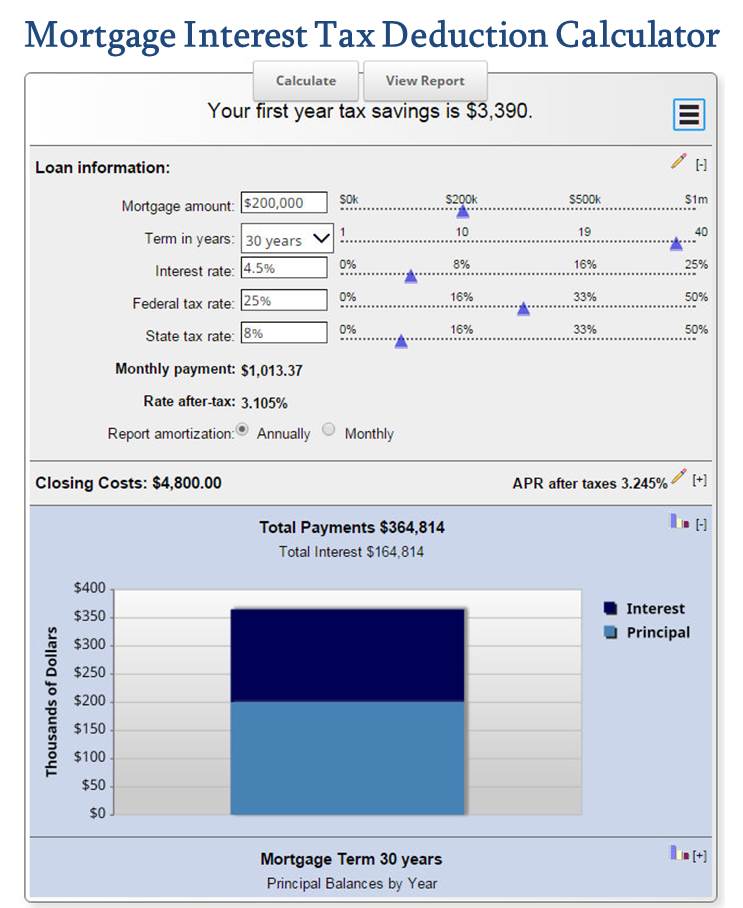

Mortgage Interest Tax Deduction Calculator Mls Mortgage

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

How To Calculate Income Tax Fy 2021 22 New Tax Slabs Rebate Income Tax Calculation 2021 22 Youtube

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Schedule C Income Mortgagemark Com

Mortgage Tax Deduction Calculator Freeandclear

How To Estimate Your Taxes To Extend Filing Deadline Forbes Advisor

Home Ownership Tax Benefits Mortgage Interest Tax Deduction Calculator

Income Tax Calculator 2021 2022 Estimate Return Refund

Tax Calculator Estimate Your Income Tax For 2022 Free

Income Tax Calculator Estimate Your Federal Tax Rate 2019 20

Tkngbadh0nkfnm

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

Mortgage Interest Tax Deduction What Is It How Is It Used

30 Year Fixed Mortgage Calculator Forbes Advisor